Research

GEoeconomic Pressure

Christopher Clayton, Antonio Coppola, Matteo Maggiori, Jesse Schreger - Working Paper, February 2025

Geoeconomic pressure—the use of existing economic relationships by governments to achieve geopolitical or economic ends—has become a prominent feature of global power dynamics. This paper introduces a methodology using large language models (LLMs) to systematically extract signals of geoeconomic pressure from large textual corpora. We analyze the ongoing trade war and update the draft at high frequency.

We provide an interactive and frequently updated version of the results and data from this paper on the GCAP Data Hub. Visit the Geoeconomic Monitor to track firms reporting being affected by various types of geoeconomic pressure.

Selected media coverage: Financial Times (1) | Financial Times (2) | The Washington Post | The Economist | The Chosunilbo

Financial Regulation and AI: A Faustian Bargain?

Christopher Clayton, Antonio Coppola - Working Paper, July 2025

We examine whether and how granular, real-time predictive models should be integrated into central banks’ macroprudential toolkit. We develop a tractable framework that formalizes the tradeoff regulators face when choosing between implementing models that forecast systemic risk accurately but have uncertain causal content and models with the opposite profile and show that even purely predictive models can generate welfare gains for a regulator. We introduce a deep learning architecture tailored to financial holdings data—a graph transformer—which attains state-of-the-art predictive accuracy in out-of-sample forecasting tasks including trade prediction.

A Theory of Economic Coercion and Fragmentation

Christopher Clayton, Matteo Maggiori, Jesse Schreger - Working Paper, March 2024

Revise & Resubmit at the Journal of Political Economy

Mechanisms that generate gains from integration and specialization, such as external economies of scale, also increase hegemonic countries’ power to exert economic influence because in equilibrium they make other relationships poor substitutes for those with global hegemons. Other countries attempt to isolate their economies from undue influence by resorting to inefficient home alternatives. The resulting fragmentation of the global trade and financial system is inefficient.

Selected media coverage: Il Sole 24 Ore (English) | Financial Times (1) | Financial Times (2) | Corriere della Sera | Financial Times (3) | Financial Times (4) | Financial Times (5) | The Economist | The Korea Economic Daily | Economic Times | Financial Times (6)

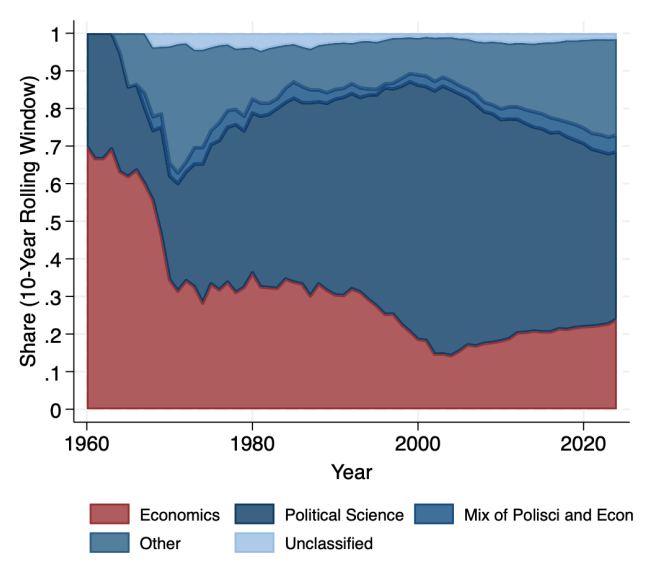

Putting Economics Back Into Geoeconomics

Christopher Clayton, Matteo Maggiori, Jesse Schreger - NBER Annual Conference on Macroeconomics, 2025

We discuss how concepts of power in the political science and economics literature can be used to guide research on geoeconomics. Economic threats as a form of coercion have seen a recent resurgence, and we show how they can be modeled and understood using basic tools of economics.

Selected media coverage: Financial Times | The Economist

A Framework for Geoeconomics

Christopher Clayton, Matteo Maggiori, Jesse Schreger - Econometrica 2026

A framework for analyzing geopolitical and economic competition around the world. Based on global financing and production networks. Geopolitical power arises from the ability of hegemons to consolidate threats across different economic domains into joint threats to exert pressure and extract surplus from other countries and firms.

Best Paper Award in Geoeconomics, for junior researchers, CEPR-Kiel-Bocconi, 2024

Selected media coverage: The Economic Times

International Currency Competition

Christopher Clayton, Amanda Dos Santos, Matteo Maggiori, Jesse Schreger - Working Paper, November 2024

We analyze how countries compete to become an international safe asset provider in a dynamic reputation framework. We show how reputation of a country can be estimated in real time using holdings data on sovereign bonds.

The geography of capital allocation in the euro Area

Roland Beck, Antonio Coppola, Angus Lewis, Matteo Maggiori, Martin Schmitz, Jesse Schreger - Working Paper, May 2024

Revise & Resubmit at Quarterly Journal of Economics

Investigates financial integration in the Euro Area focusing on the role of European “onshore offshore financial centers” (OOFCs): Luxembourg, Ireland, and the Netherlands.

Full ECB report on Financial Integration and Structure in the Euro Area

Corporate Debt Structure with Home and International Currency Bias

Matteo Maggiori, Brent Neiman, Jesse Schreger - IMF Economic Review, 2024, written for IMF conference in honor of Ken Rogoff

We explore the consequences of global capital market segmentation by currency for the currency composition of corporate debt.

GLOBAl capital allocation

Sergio Florez-Orrego, Matteo Maggiori, Jesse Schreger, Ziwen Sun, Serdil Tinda - Annual Review of Economics, 2024

We survey the literature on global capital allocation.

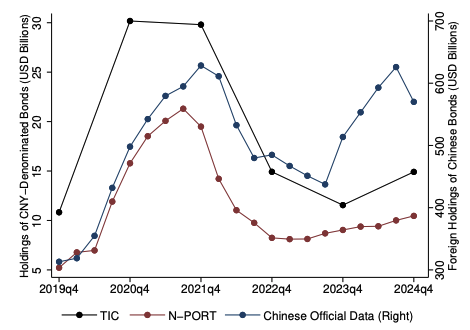

Internationalizing like china

Christopher Clayton, Amanda Dos Santos, Matteo Maggiori, Jesse Schreger — American Economic Review 2025

We investigate the foreign holdings of Renminbi bonds and provide a theoretical framework to understand China's strategy to internationalize its currency.

Selected media coverage: Bloomberg | The Economist | Business Insider | Bloomberg

Redrawing the Map of Global Capital Flows: The Role of Cross-Border Financing and Tax Havens

Antonio Coppola, Matteo Maggiori, Brent Neiman, Jesse Schreger — Quarterly Journal of Economics, 2021

A methodology to restate global capital flow statistics from a residency to a nationality basis. Unmasks issuance in tax havens. Flows from developed countries to emerging market are much larger than previously known.

Selected media coverage: The Economist | Financial Times | Bloomberg | Financial Times, Alphaville | The Wire China | Il Sole 24 Ore (1) | Il Sole 24 Ore (2) | NBER Digest

EXCHANGE RATE RECONNECT

Andrew Lilley, Matteo Maggiori, Brent Neiman, Jesse Schreger — Review of Economics and Statistics, 2022

After the 2008 financial crisis, exchange rates reconnected to U.S. purchases of foreign bonds and measures of risk premia. Sheds new light on exchange rate disconnect.

International Currencies and Capital Allocation

Matteo Maggiori, Brent Neiman, Jesse Schreger — Journal of Political Economy, 2020 (Lead Article)

Establishes the presence of home currency bias and shows that in bonds home bias is largely the result of home currency bias. The U.S. dollar’s special status allows U.S. firms to overcome foreigners’ home currency bias.

Selected media coverage: WSJ | Forbes | NBER Digest | PI | Market Watch (1) 1 | Market Watch (2) | Central Banking | World Economic Forum | The Economist

American Investment in Chinese Renminbi

Bruno Cavani, Christopher Clayton, Amanda Dos Santos, Matteo Maggiori, Jesse Schreger - In preparation for the AEA Papers and Proceedings, 2026

We document the rise and subsequent retreat of U.S. investment in Chinese renminbi-denominated bonds, showing that recent declines are driven primarily by U.S. funds exiting RMB positions altogether amid heightened geopolitical tension.

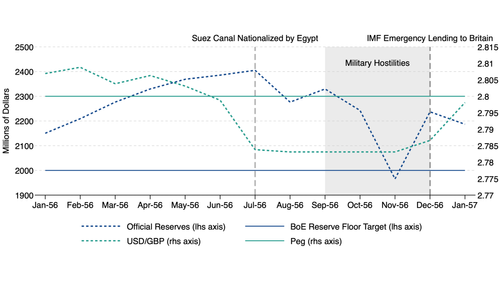

Global Imbalances and Power Imbalances

Christopher Clayton, Matteo Maggiori, Jesse Schreger - In preparation for the AEA Papers and Proceedings, 2026

A short paper examining how global imbalances may give rise to power imbalances, as illustrated by the Suez Crisis.

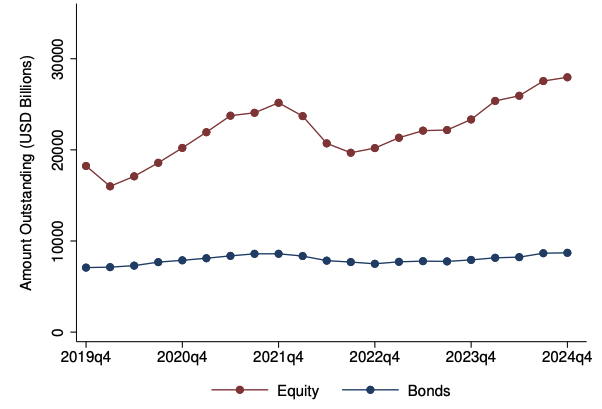

GCAP Public Security-Level Data on U.S. Fund Holdings

Bruno Cavani, Matteo Maggiori, Jesse Schreger - White Paper, October 2025

We construct representative security-fund-level longitudinal data for the United States using regulatory filings of portfolio holdings from Form N-PORT. Our results confirm that N-PORT data offer a comprehensive, reliable, and public source for research in macroeconomics and finance. We make all the security-level data on holdings available in a public repository of the GCAP Lab and provide code for updating the data.

The Political Economy of Geoeconomic Power

Christopher Clayton, Matteo Maggiori, Jesse Schreger - AEA Papers and Proceedings, 2025

Great powers are increasingly using their economic and financial strength for geopolitical aims. This rise of "geoeconomics" has the potential to reshape the international trade and financial system. This paper examines the role of domestic political economy forces in determining a government's ability to project geoeconomic power abroad. We also discuss the role that persuading or coercing foreign governments plays in projecting geoeconomic power around the world.

Selected media coverage: Central Banking | Corriere della Sera | Economic Times

China In Tax Havens

Christopher Clayton, Antonio Coppola, Amanda Dos Santos, Matteo Maggiori, Jesse Schreger – AEA Papers and Proceedings, 2023

We document the rise of China in offshore capital markets over the past twenty years.

Selected media coverage: Bloomberg | New York Times | The Wire China

The Rise of the Dollar and Fall of the Euro as International Currencies

Matteo Maggiori, Brent Neiman, Jesse Schreger — AEA Papers and Proceedings, 2019

Starting with the 2008 financial crisis, the U.S. dollar experienced an increase in its international currency role, while the Euro experienced a corresponding decline. The switch is broad-based across bonds, loans, and invoicing in goods markets.

Geoeconomic Pressure

Christopher Clayton, Antonio Coppola, Matteo Maggiori, Jesse Schreger – May 2025

Our new paper “Geoeconomic Pressure” leverages recent advances in large language models (LLMs) to identify the areas of the global economy that are particularly vulnerable to geoeconomic pressure and examine how targeted entities respond.

We provide an interactive and frequently updated version of the results and data from this paper on the GCAP Data Hub. Visit the Geoeconomic Monitor to track firms reporting being affected by various types of geoeconomic pressure.

Economic Coercion and Fragmentation

Christopher Clayton, Matteo Maggiori, Jesse Schreger – December 2024

Our new paper “A Theory of Economic Coercion and Fragmentation” explains how anti-coercion policies, enacted to counteract demands from hegemonic powers like the United States and China, operate at an individual country level and impact the global economy at large.

Selected media coverage: Il Sole 24 Ore (English) | Financial Times (1) | Financial Times (2) | Corriere della Sera | Financial Times (3)

The State of Financial Integration in the Euro Area

Roland Beck, Antonio Coppola, Angus Lewis, Matteo Maggiori, Martin Schmitz, Jesse Schreger – May 2024

Our new paper “The Geography of Capital Allocation in the Euro Area” provides a new assessment of the financial risk exposures and of the state of financial integration within the Euro Area.

Full ECB report on Financial Integration and Structure in the Euro Area

A Framework for Geoeconomics

Christopher Clayton, Matteo Maggiori, Jesse Schreger – January 2024

The Global Capital Allocation Project has released a new paper “A Framework for Geoeconomics” that analyzes how countries build and yield geoeconomic power.

Internationalizing Like China

Christopher Clayton, Amanda Dos Santos, Matteo Maggiori, Jesse Schreger – January 2023

We investigate the foreign holdings of Renminbi bonds and provide a theoretical framework to understand China's strategy to internationalize its currency.

Selected media coverage: Bloomberg | The Economist | Business Insider | Bloomberg

New Estimates of Global Capital Allocation, 2018-20

Antonio Coppola, Matteo Maggiori, Jesse Schreger, Angus Lewis, Ziwen Sun, Serdil Tinda – December 2022

The Global Capital Allocation Project has released updated estimates of global portfolio positions, including unwinding positions in tax havens that otherwise obfuscate the true underlying economic relationships. The new estimates cover the years 2018-20.

Selected media coverage: The Economist | Financial Times | Bloomberg | Financial Times, Alphaville | The Wire China | Il Sole 24 Ore (1) | Il Sole 24 Ore (2) | NBER Digest